A Sedley Koschel Self Managed Super Fund helps you stay in control of your financial future. Superannuation SMSF specialists master in the set-up, administration, and management of Superannuation funds. Our offices are located in Brisbane, Hope Island and Mount Isa. Our qualified SMSF professionals can explain the tax benefits, bottom-line costs, and the rules associated with borrowing through your SMSF to invest in property (LRBAs). Get the best superannuation investment options from our SMSF Financial Advisers.

Talking to a Sedley Koschel Financial Planning professional will provide you with a clearer picture on what is the best solution for your SMSF. As the Australian Government encourages everyone to take responsibility for and reach individual financial retirement goals, more importance is placed on securing our own Superannuation.

Self Managed Super Funds (SMSF) are a specialized retirement savings plan, used to accumulate superannuation monies for the retirement benefits of its members and is one of the best means of saving for retirement. SMSF allows you to steer your own investment strategy, reduce tax while obtaining tax benefits, and minimize administration costs.

Self Managed Superannuation Funds are now among the most popular type of funds within the superannuation industry in Australia – with far better performance results than retail and industry funds. With more than a million Australians now enjoying a combined asset pool of $550 billion, the increasing popularity of SMSFs is well-founded.

A Self Managed Superannuation Fund (SMSF) is a specialized retirement savings plan used to accumulate superannuation monies for the retirement benefits of its members. Self Managed Superannuation Funds (SMSF) are now among the most popular types of funds within the superannuation industry in Australia and have grown in popularity due to numerous advantages over a traditional industry or retail superannuation funds such as:

Greater control over how the fund’s assets are invested. The ability to control their superannuation interests is a major factor for individuals looking to establish their own SMSF.

The ability to invest directly into a residential and commercial property. Trustees are able to invest in assets of their choice and recover excess franking credits from the Australian Taxation Office each financial year.

The possibility of borrowing funds in your SMSF for property or other investments.

Ability to pool your funds with family members, and flexibility when transitioning into retirement.

SMSF’s also have the capacity to cater for various tax advantages and in a lot of cases, the real possibility of lower running costs and greater risk management.

Still not sure if SMSF is for you? Are you currently in a retail super scheme and not sure how it is comparing? Sedley Koschel Wealth can assist with both the setup and ongoing administration of your SMSF. Contact us today or call us on 1300 001 108 to discuss your SMSF questions.

The team at Sedley Koschel Superannuation has years of combined experience specifically with the setup and ongoing management of SMSFs. Director, Robert Koschel holds the highest accreditation with the SMSF Association of Australia. Our Superannuation admin team can quickly and efficiently set up Self Managed Super Funds and assist with all of your paperwork.

Give us a call today on 1300 001 108 or schedule a 30-minute obligation-free consultation at a time that suits you. Self Managed Superannuation Funds are now among the most popular type of funds within the superannuation industry in Australia.

It is important to set up your SMSF properly so that it’s eligible for tax concessions and easier to manage once up and running. You’ll need to find a Self Managed Super Funds expert to help you with the initial setup. Choose a firm that is a member of the SMSF Association of Australia to take you through the ATO requirements.

SMSFs operate in the same way as any other superannuation fund however with SMSFs, the responsibility of managing the fund rests with the trustee. With an SMSF, you can be both a member and a trustee, therefore establishing an SMSF can be a major decision and process. With this control comes greater obligation and risk. It is strongly advised that trustees should either set aside ample time to run their fund or appoint an SMSF specialist to assist them in the ongoing administration, compliance requirements, and investment implementation.

It is always important to seek professional advice with any type of investment plan for retirement or wealth creation. Partner and Head of the Sedley Koschel Superannuation division; Robert Koschel is a qualified SMSF Specialist and holds accreditation with the SMSF Association of Australia. Robert is happy to field any questions you might have in regards to SMSF.

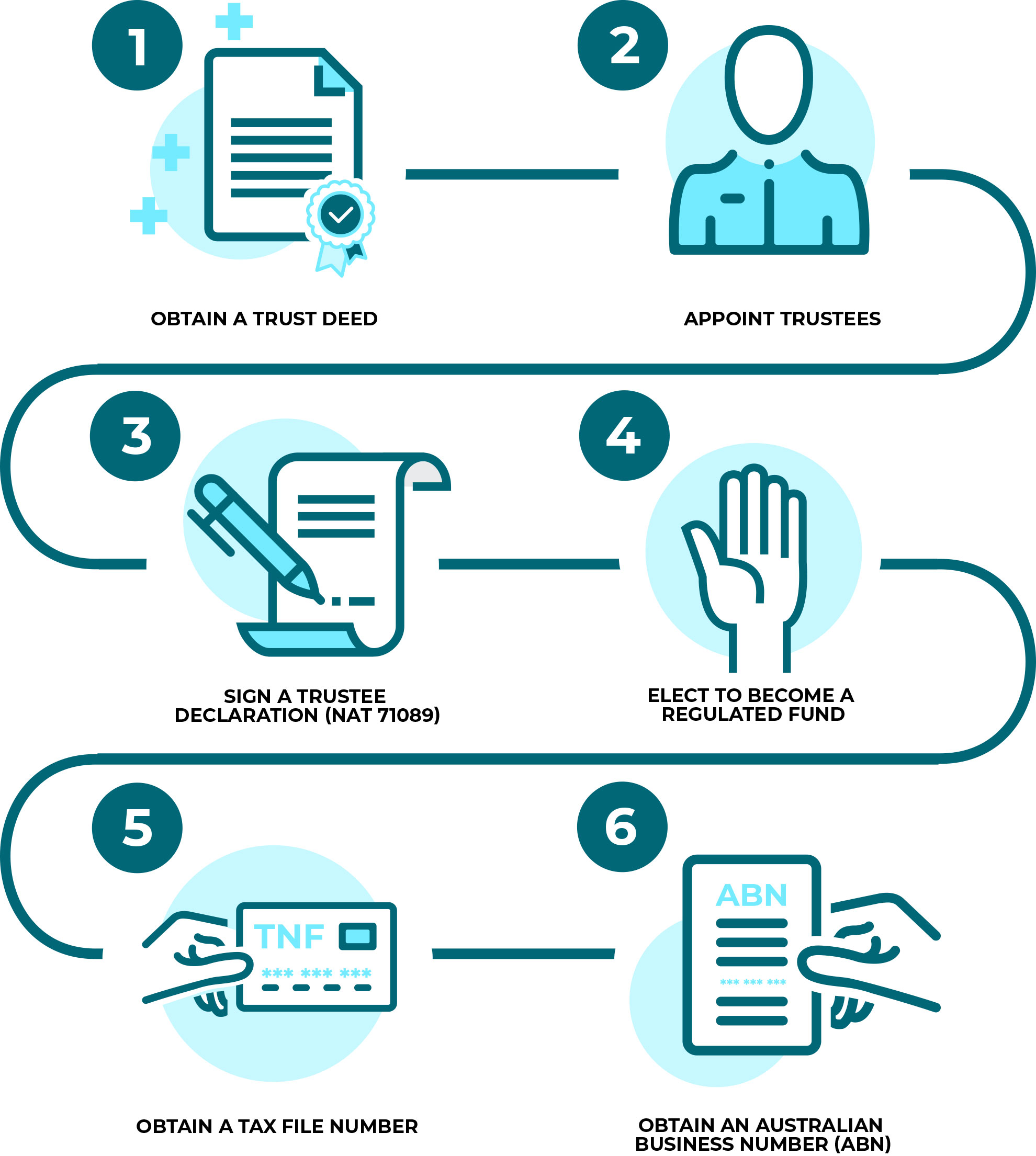

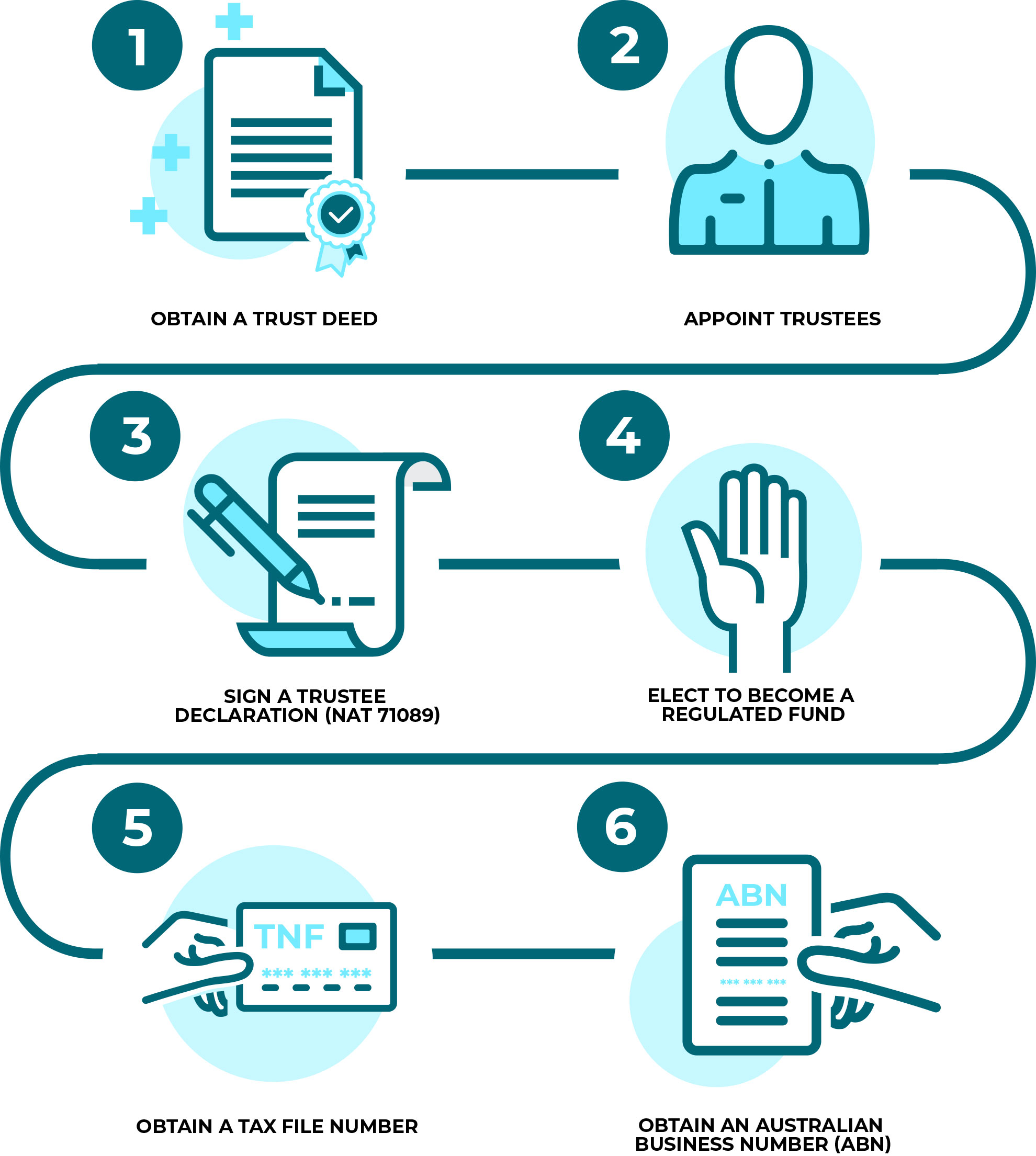

Typically you need to:

Superannuation law is a delicate area and personalized planning is required for each individual. We encourage you to seek advice from an independent planner who is an approved member of the SMSF Association of Australia before establishing an SMSF. At Sedley Koschel, we can take you through all the requirements to set up an SMSF. Simply schedule a consultation with us online and we’ll call you at a time that suits your busy schedule.

If you have been searching for the right Super Fund advisors who can meet your needs and help navigate an ever-changing economic landscape, we would love to work with you. Call us today on 1300 008 108 -or- schedule an obligation free consultation at a time that suits you.

We offer a wide range of financial services from one location. These services include: Tax Agents & Accountants, Small Business Advice, Financial Advisors & Financial Planners, Wealth Accumulation Advice, Your Own Personal Wealth Portal, Self Managed Super Funds (SMSF), Wills & Estate Law, Age Care Advice and Financial Planning, Tailored Insurance Services, Property Investment Services, Small Business Virtual CFO, and ask us about Probate Law….

Are you looking for our client portal login? CLICK HERE to visit My Prosperity Portal

We acknowledge and pay respects to the people of the Yugambeh language region of the Gold Coast and The Kalkadoon People of Mt Isa and all their descendants both past and present. We also acknowledge the many Aboriginal people from other regions as well as Torres Strait and South Sea Islander people who now live in the local area and have made an important contribution to the community.

Other points to consider when setting up Self Managed Super Funds. Costs, rules, and legal documents are among the most important factors to think about when planning Self Managed Super Funds.

Want to find out the rules for buying property through your Superfund? There are numerous tax advantages for holding property within SMSF and there are complicated rules associated with borrowing to invest in residential or commercial property within your superannuation. It is therefore advisable to speak with your Accountant and Financial Planner before searching for a suitable investment property or arranging any type of finance.

Sedley Koschel Wealth Pty Ltd is a Corporate Authorised Representative (No.326979) ABN 60 082 422 320 of Professional Investment Services Pty Ltd.

Robert Koschel is a sub-authorised representative (ARN 244979) of Sedley Koschel Wealth Pty Ltd.

T: 1300 557 598 | F: 02 8987 3075 | Email | Website

ABN 11 074 608 558 | Australian Financial Services Licence No. 234951

Click here for the FSG and Privacy Policy

Click here for the PIS Complaints Procedure

The information provided on this website has been provided as general advice only. We have not considered your financial circumstances, needs, or objectives and you should seek the assistance of your Professional Investment Services (PIS) Authorised Representative before you make any decision regarding any products mentioned in this communication. Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided, and accordingly neither Professional Investment Services nor its related entities, employees, or agents shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information.